The investments have been largely led by PE funds that have been more inclined to back legacy firms. Over the years, PE funds have also actively evaluated deals in new age tech firms and invested in companies in the space – Dream11, Sugar are among startups that have been backed by PE investors like TPG and L Catterton.

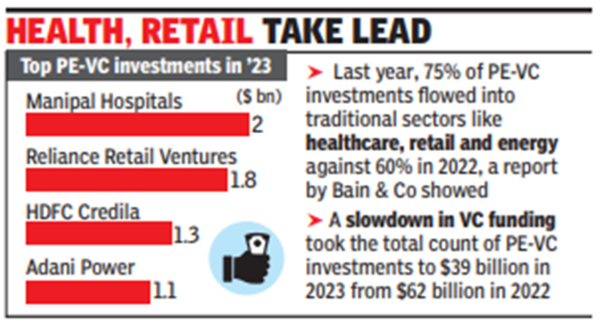

Last year, 75% of PE-VC investments flowed into traditional sectors like healthcare, retail, energy and advanced manufacturing against 60% in 2022, a report by Bain & Co showed.

While investments in healthcare hit a record high of $5.5 billion in 2023, a series of PE investments into Reliance’s retail unit shored up the share of consumer deals. Typically, VCs invest largely in startups, which entails more risk. PEs, however, tend to invest more in established companies.

Although a slowdown in VC funding took the total count of PE-VC investments to $39 billion in 2023 from $62 billion in 2022, India’s share of PE-VC investments in Asia-Pacific has grown over the past five years alongside Japan. China’s share declined to 31% in 2023 from 55% in 2018.

“Favourable policies in India such as production-linked incentives, export promotion initiatives, and customs duty rationalisation drove some shift in economic activity and subsequent investments to India…..global firms diversified production outside China,” analysts at the firm said.

Even as analysts have flagged sluggish global GDP growth and geopolitical tensions in West Asia as risks to investor appetite, which may lead to cautious deployment of capital in 2024 as well, the overall tally may be better than the previous year. Investments in 2024 continue to see green shoots over 2023, Sai Deo, partner at Bain & Co told TOI. “India as a centre within Asia-Pacific is becoming important,” Deo said.

Last week, TOI had reported that several global and domestic PE and VC funds have raised new funds and are scouting for investments. Share of domestic funds in India has steadily grown, increasing their share of PE investments by 2.5 times over the past four years. “This trend has been accompanied by a significant expansion of India-based teams by PE funds, growing roughly twofold over 2019-23.

“Leading global funds are planning to ramp up capital allocation to India”, analysts at Bain said, adding that players such as KKR and Blackstone entered new asset classes like growth and private credit over 2021-23.