Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Blackstone chief executive Stephen Schwarzman took home more than $1bn in 2024 as the private equity titan saw his income rise due to a rebound in investment activity at the world’s largest alternative investment group, according to the company’s annual report released late on Friday.

Schwarzman’s income marked a 9 per cent increase from the prior year, fuelled entirely by rising dividend payments from his enormous Blackstone shareholding. The Blackstone co-founder owns 19 per cent of the New York-based investment group and has for years received hundreds of millions of dollars annually in dividends paid out from its profits.

Blackstone increased its dividend payouts to shareholders by about 18 per cent in 2024 as its so-called distributable earnings, a metric analysts favour as a proxy for cash flows, increased by a similar measure. Blackstone historically pays out at least 85 per cent of such profits to all of its shareholders, which include Schwarzman and many other top executives, such as president Jonathan Gray.

Overall, Schwarzman received $916mn in dividends and compensation of $84mn, with the bulk of that coming from “carried interest” performance fees Blackstone earns when it sells investments profitably. In 2023, he received about $900mn, a decline versus the prior two years when he took home $1.1bn and $1.3bn, respectively.

Gray took home $247mn, with about 69 per cent coming from dividend income on his shares. Chief financial officer Michael Chae and Joseph Baratta, Blackstone’s head of private equity, took home $48.9mn and $60.1mn, respectively.

Executives at Blackstone can receive outsized income in good years because the group traditionally pays almost all of its profits to shareholders in dividends. Rivals such as KKR and Apollo Global have more stable dividend policies and retain some of their profits to fund future expansion.

In 2024, Blackstone sold more than $87bn of assets, a 33 per cent increase from the prior year, fuelling the performance-based revenue it in turn paid out to shareholders. Its finances were also bolstered by a recovery in financial markets, which helped Blackstone raise $171bn in new investor cash and invest $134bn. Both figures were near record amounts for the group.

“Blackstone has a performance-driven compensation model that is built on long-term alignment with our investors,” a spokesperson said.

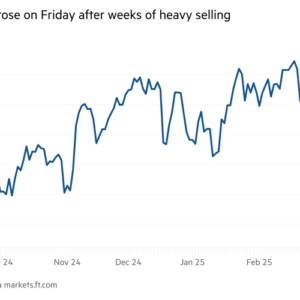

Wealth inside Blackstone has surged in recent years, fuelled by its soaring stock valuation after it was included in the popular S&P 500 index in 2023.

Blackstone’s top leaders saw their shares rise by $13.5bn in 2024 as its market value soared nearly 50 per cent to $214bn, before falling slightly this year.

The share surge has created billion-dollar stock holdings for a widening group of executives beyond Schwarzman and Gray, who hold shares worth $37bn and $7bn, respectively. Chae and Baratta only last year saw their shares exceed $1bn in value. They each currently hold shares worth about $1.1bn, according to securities filings.