Stay informed with free updates

Simply sign up to the German economy myFT Digest — delivered directly to your inbox.

The word “bazooka” is an overused metaphor for financial policy decisions. But it is entirely fitting to describe Germany’s Damascene conversion to deficit spending — a political agreement to ditch deficit limits altogether for defence spending, and a massive €500bn special fund for infrastructure outside the regular budget bound by the country’s constitutional “debt brake”.

If the reform is passed — it still needs to be put to a vote by German lawmakers before the parliamentary arithmetic changes — it will largely remove Germany’s self-imposed obstacles to the policy impetus its economy sorely needs. Just the infrastructure funds, if phased in rapidly, could end a stagnation that has lasted two years and counting. Sober economists contemplate a doubling of the potential growth rate.

The combination of making good past shortfalls in infrastructure investment and boosting defence spending should also address Germany’s industrial policy changes. Both can help with the transformation away from declining industries. Modern infrastructure should complement manufacturing for a decarbonised economy. The defence sector is already absorbing people and skills no longer needed in the internal combustion engine supply chain.

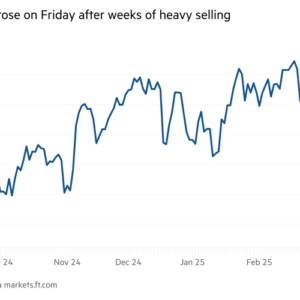

Markets are applauding. As a Kiel Institute policy brief notes, the increase in German borrowing costs after the announcement was accompanied by rising stock prices, an appreciating euro, a steeper yield curve and stable default insurance — all pointing to improved growth expectations.

So Berlin’s about-turn will be good for the country. But it will have repercussions beyond Germany — and beyond security.

It is hard to exaggerate the revolution in EU budgetary politics entailed by Berlin’s shift from being the bloc’s deficit scourge to its weightiest advocate of deficit spending. When the “fiscal governance review” restarted after the pandemic, it was Germany’s then finance minister who fought the hardest to tighten the EU’s reformed budget rules beyond the European Commission’s proposal. Berlin now complains that Brussels is not relaxing the rules enough.

Its frugal friends in northern Europe could be forgiven for being irritated. But they are undergoing a similar shift, with Denmark’s prime minister calling on her partners to “spend, spend, spend” on defence. When geopolitics forces you to choose between being a fiscal hawk and a defence hawk, it’s fiscal rectitude that gives. As a result, the politics of EU budgets have suddenly become much more open-ended.

If this German volte-face was possible, what else might be? Possibly a change in Berlin’s opposition to using Russia’s blocked foreign exchange reserves, more than €200bn of which are subject to Eurozone jurisdiction. Transferring these to Ukraine as a down payment on Moscow’s obligation to compensate for its destruction is the single most important game changer Europe could play. It would dramatically shift the balance of resources back in Kyiv’s favour after the withholding of US support. And it would demonstrate that, on its continental security, Europe is an autonomous player to reckon with.

Possibly, too, a greater German openness to “eurobonds”, or common European borrowing. The Rubicon was already crossed when then chancellor Angela Merkel agreed to an €800bn EU pandemic recovery fund in 2020. Berlin and other fiscal hawks have always insisted this was a one-off. And yet, no one objected to last week’s European Commission proposal for a €150bn common borrowing facility; indeed, it received political backing at the highest level within 60 hours of being presented — surely a record. It is just a matter of time before a bigger, yes, bazooka is seen as not just acceptable but required.

Even Germany’s purely domestic spending could have wide-ranging continental implications. It will no longer be a drag on Eurozone aggregate demand. Its structural change may help reorient the EU’s export surplus towards investments at home.

Because of the sheer weight of Germany’s share in European spending, it has an outsized opportunity to shape the coming defence investment burst and enhance procurement efficiency and military effectiveness. It could, for example, invite other countries to join its orders for expensive materiel, unleashing economies of scale for everyone. It could help push for the politically thorny but financially and militarily necessary streamlining of standards, specifications and technical interoperability. Both literally and metaphorically, Berlin can get Europe more bang for the buck — or for the euro.