Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

We are living in the early stages of a revolution — the attempted conversion of the American republic into an arbitrary dictatorship. Whether Donald Trump will succeed in this attempt is, as yet, unclear. But what he wants to do seems self-evident. His way of governing — lawless, unpredictable, anti-intellectual, nationalist — will have the greatest impact on the US itself. But it is, inevitably, having a huge impact on the rest of the world, too, given the hegemonic role of the US since the second world war. No other country or group of countries can — or wants — to take its place. This revolution threatens chaos.

It is far too early to know what the full consequences will be. But it is not too early to make informed guesses on some aspects, notably the unpredictability and consequent loss of confidence being created by Trump’s tariff war. This loss of confidence was the theme of a podcast I did recently with Paul Krugman. Without predictable policies, a market economy cannot function well. If the uncertainty comes from the hegemon, the world economy as a whole will not function well either.

In its latest Global Economic Prospects, the World Bank has analysed just this. Its conclusions are inevitably provisional, but the direction of travel must be correct. It starts from the assumption that the tariffs in place in late May will remain over its forecast horizon. This might be too optimistic or too pessimistic. Nobody, perhaps not even Trump, knows. “In this context”, it judges, “global growth is projected to slow markedly to 2.3 per cent in 2025 [0.4 percentage points below the January 2025 forecast]— the slowest pace since 2008, aside from two years of outright global recession in 2009 and 2020. Over 2026-27, a pick-up in domestic demand is expected to lift global growth to a still subdued 2.5 per cent — far below the pre-pandemic decadal average of 3.1 per cent.”

All this is bad enough. But risks seem overwhelmingly to the downside. Thus, the uncertainty created by Trump’s trade war could lead to far greater declines in trade and investment than projected. Certainly, it will be hard to trust in any supposed “deals” now announced. Again, lower growth will increase social, political and fiscal fragility, so raising perceptions of risk in markets. This might create a doom-loop, with higher costs of finance increasing risk and lowering growth. Weak borrowers, private and public, might be driven into default. Shocks from natural disasters or conflict would then be even more economically damaging.

Upsides can be imagined. New trade deals might be reached, in which many might, courageously, trust. AI-fairy-dust might cause a surge in global productivity and investment. Also, everything might just calm down. A difficulty for this is that today’s Trump shock comes after almost two decades of shocks: global and Eurozone financial crises; pandemic; post-pandemic inflation; and Ukraine-Russia war. Animal spirits must have been impaired.

Alas, as Indermit Gill, World Bank chief economist, stresses in his foreword, “the poorest countries will suffer the most”. “By 2027, the per capita GDP of high-income economies will be roughly where it had been expected to be before the Covid-19 pandemic. But developing economies would be worse off, with per capita GDP levels 6 per cent lower.” With the exception of China, it might take two decades for these countries to recoup their losses of the 2020s.

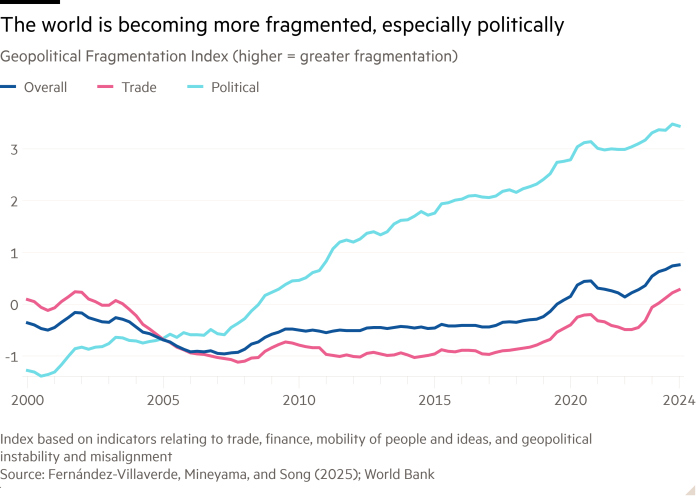

This is not just a result of recent shocks. Thus, “Growth in developing economies has been ratcheting downward for three decades in a row — from an average of 5.9 per cent in the 2000s, to 5.1 per cent in the 2010s to 3.7 per cent in the 2020s.” This tracks the declining growth of world trade, from an average of 5.1 per cent in the 2000s to 4.6 per cent in the 2010s to 2.6 per cent in the 2020s. Meanwhile, debt is piling up. In the long run, it will not help that Trump insists climate change is a myth, too.

So, what is to be done? First, liberalise trade. While developing countries have liberalised substantially in recent years, most of them still have far higher tariffs than high-income economies. Targeted infant-industry promotion can work. But if a country has little international leverage, the best policy remains one of free trade, coupled with the best possible policies for attracting investment, improving human capital and preserving economic stability. In a bad environment, as now, this is even more important than in a benign one.

The choices for bigger powers — China, the EU, Japan, India, the UK and others — are more complex. First, they, too, need to improve their own policies to the greatest possible extent. They also need to co-operate in trying to sustain global rules among themselves, not least on trade. Some powers need to recognise that global imbalances are indeed a significant issue, though they are not about trade policy but rather global macroeconomic imbalances.

This is far from all. As the US retreats from its historic role, others are having greatness thrust upon them. Continued progress on addressing the challenges of climate change and economic development depends on these powers. A better way to resolve excessive debts is necessary, for example. That requires going against today’s trend towards ever greater suspicion of one another.

It is possible — even likely — that we are witnessing the withering away of a great effort to promote a more prosperous and co-operative world. Some people will say that such an ending would just signal healthy “realism”. But it would be a folly: we share one planet; and so our destinies are intertwined. Modern technology has made this inescapable. We are at a turning point: we must choose wisely.