Epoxydude | Fstop | Getty Images

A Consumer Financial Protection Bureau regulation that promised to save Americans billions of dollars in late fees on credit cards faces a last-ditch effort to stave off its implementation.

Led by the U.S. Chamber of Commerce, the card industry in March sued the CFPB in federal court to prevent the new rule from taking effect.

That effort, which bounced between venues in Texas and Washington, D.C., for weeks, is now about to reach a milestone: a judge in the Northern District of Texas is expected to announce by Friday evening whether the court will grant the industry’s request for a freeze.

That could hold up the regulation, which would slash what most banks can charge in late fees to $8 per incident, just days before it was to take effect on Tuesday.

“We should get some clarity soon about whether the rule is going to be allowed to go into effect,” said Tobin Marcus, lead policy analyst at Wolfe Research.

The credit card regulation is part of President Joe Biden’s broader election-year war against what he deems junk fees.

Big card issuers have steadily raised the cost of late fees since 2010, profiting off users with low credit scores who rack up $138 in fees annually per card on average, according to CFPB Director Rohit Chopra.

New fees, higher rates

As expected, the industry has mounted a campaign to derail the regulations, deeming them a misguided effort that redistributes costs to those who pay their bills on time, and ultimately harms those it purports to benefit by making it more likely for users to fall behind.

Up for grabs is the $10 billion in fees per year that the CFPB estimates the rule would save American families by pushing down late penalties to $8 from a typical $32 per incident.

Card issuers including Capital One and Synchrony have already talked about efforts to offset the revenue hit they would face if the rule takes effect. They could do so by raising interest rates, adding new fees for things like paper statements, or changing who they choose to lend to.

Capital One CEO Richard Fairbank said last month that, if implemented, the CFPB rule would impact his bank’s revenue for a “couple of years” as the company takes “mitigating actions” to raise revenue elsewhere.

“Some of these mitigating actions have already been implemented and are underway,” Fairbank told analysts during the company’s first-quarter earnings call. “We are planning on additional actions once we learn more about where the litigation settles out.”

Trial ahead?

Like some other observers, Wolfe Research’s Marcus believes the Chamber of Commerce is likely to prevail in its efforts to hold off the rule, either via the Northern District of Texas or through the 5th Circuit Court of Appeals. If granted, a preliminary injunction could hold up the rule until the dispute is settled, possibly through a lengthy trial.

The industry group, which includes Washington, D.C.-based trade associations like the American Bankers Association and the Consumer Bankers Association, filed its lawsuit in Texas because it is widely viewed as a friendlier venue for corporations, Marcus said.

“I would be very surprised if [Texas Judge Mark T.] Pittman denies that injunction on the merits,” he said. “One way or another, I think implementation is going to be blocked before the rule is supposed to go into effect.”

The CFPB declined to comment, and the Chamber of Commerce didn’t immediately respond to a request for comment.

Don’t miss these exclusives from CNBC PRO

Related Posts

Amazon boss says AI will mean fewer ‘corporate’ jobs

Artificial intelligence myFT Digest — delivered directly to your inbox.

Read more

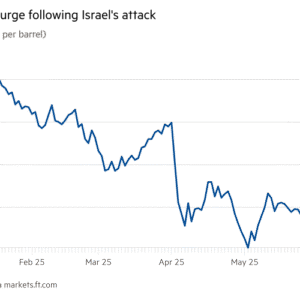

Oil prices surge after Israel’s attack on Iran

Oil myFT Digest — delivered directly to your inbox.

Read more