[ad_1]

CNBC’s Jim Cramer on Friday guided investors through the upcoming earnings-packed schedule on Wall Street, saying to focus on reports from companies such as Uber, Disney and Warner Bros. Discovery. Since April’s labor report was weaker than expected, he said investors can worry less about the Federal Reserve’s next move.

“Now that it’s clear the economy’s having a meaningful slowdown, we no longer need to worry about the Fed becoming our enemy again,” he said, adding, “Which means we can go back to glorious stock picking mode, at least for like a couple of days, thanks to the benign employment number.”

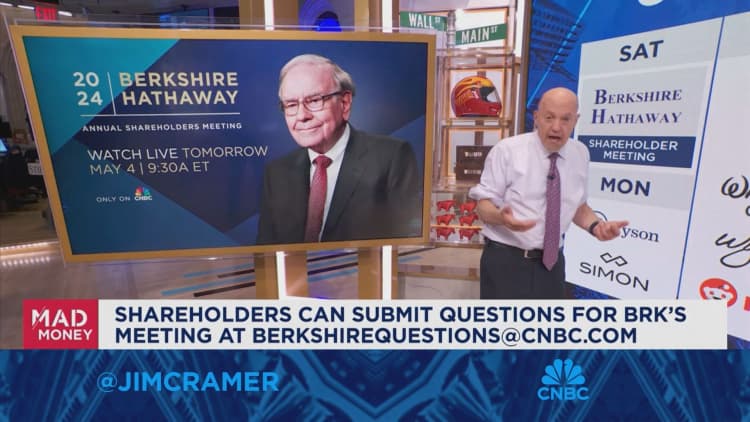

On Saturday, Cramer said investors should follow Warren Buffett’s annual meeting, which could be bullish for Berkshire Hathaway and stocks in its portfolio such as American Express, Apple, Coca-Cola and Occidental Petroleum. Monday brings earnings from Simon Property Group and Tyson Foods, the latter of which Cramer said he thinks could be a “bounce-back play.”

Disney reports on Tuesday before the bell, and Cramer said he expects results to be positive after the cost cuts and initiatives management put in place to win its recent proxy battle. Wynn Resorts and Reddit also release earnings that day, and Cramer said he thinks both could put up solid numbers.

Cramer will be paying attention to Uber’s report on Wednesday, saying he wonders whether its earnings will be hurt by competition from Lyft. Toyota, Arm, Robinhood, Trade Desk, AMC Entertainment and Airbnb also report. He said he thinks Robinhood will do well because cryptocurrency remains popular.

Roblox reports Thursday and Cramer said he expects it to be positive. Warner Bros. Discovery also reports, and Cramer said he wonders whether the company has lowered its debt and if it will keep its contract with the National Basketball Association. He said he is also interested to hear from Akamai Technologies and Tapestry. The latter’s report could address the Federal Trade Commission’s suit to stop its merger with Capri.

On Friday, Cramer will be waiting for earnings from Enbridge. He said some investors are skeptical the company can pay its dividend. To Cramer, the dividend is safe, but he said he needs to see more aggressive growth to justify owning the stock.

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club Charitable Trust holds shares of Disney, Apple and Wynn Resorts.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com

[ad_2]

Source link