Federal authorities on Friday charged Fat Brands and its chair Andy Wiederhorn of committing a brazen scheme that netted him $47 million in bogus loans from the restaurant company that owns Fatburger, Johnny Rockets and Twin Peaks.

Shares of Fat Brands closed down 27% on Friday. The company has a market value of $92 million.

Fat Brands, Wiederhorn and a few other people were criminally indicted by a federal grand jury in Los Angeles for wire fraud, tax evasion and other counts related to the alleged scheme.

In a separate civil complaint, the U.S. Securities and Exchange Commission accused the company and Wiederhorn of violations related to the same conduct.

“These charges are unprecedented, unwarranted, unsubstantiated and unjust,” Fat Brands counsel Brian Hennigan said in a statement. “They are based on conduct that ended over three years ago and ignore the Company’s cooperation with the investigation.”

Wiederhorn, who was convicted two decades ago in a criminal case that involved similar conduct, was separately criminally charged in an indictment in Los Angeles of being a federal felon in possession of a handgun and ammunition.

“We look forward to making clear in court that this is an unfortunate example of government overreach — and a case with no victims, no losses and no crimes,” Wiederhorn’s attorney Nicola Hanna said.

As chief executive of Fat Brands, Wiederhorn, 58, allegedly directed the company to loan its own funds to him, with no intention of ever paying the “sham” loans back, according to the indictment.

The SEC alleges that Wiederhorn then used the cash to pay for private jets, first-class airfare, luxury vacations, mortgage and rent payments, plus nearly $700,000 in “shopping and jewelry.”

Wiederhorn stepped down as CEO last year, following the company’s disclosure that the SEC was investigating him. In February, Fat Brands disclosed it had received a Wells notice from the agency, meaning the SEC was planning to take action against it.

Wiederhorn’s alleged fraud accounted for roughly 44% of Fat Brands’ revenue between 2017 and 2021, which meant the company often was not able to pay its bills. In those situations, Wiederhorn would allegedly redirect funds from credit cards paid for by Fat Brands back to the company with assistance from his son Thayer, who was then the company’s chief marketing officer and is now its chief operating officer.

Fat Brands never disclosed the cash transfers as related party transactions to investors. In 2020, the cash transfers were written off after the company’s merger with Fog Cutter Capital Group, Fat Brands’ largest shareholder, which also happened to be majority owned by Wiederhorn, according to the SEC complaint.

Ron Roe, the company’s vice president of finance and former chief financial officer, and Rebecca Hershinger, another former CFO, were also named as defendants in the SEC complaint. Hershinger and tax advisor William Amon were also named in the indictment. Hershinger’s attorney Michael Proctor said in a statement to CNBC that the charges are baseless.

Additionally, as far back as 2006, Wiederhorn has owed taxes for his personal income to the IRS. He also did not report any of the so-called loans from Fat Brands as income, according to the indictment. As of March 2021, Wiederhorn owed $7.74 million to the IRS for his unpaid personal taxes.

Twenty years ago, he pleaded guilty to filing a false tax return and paying an illegal gratuity to an associate while leading Fog Cutter Capital. He paid a $2 million fine and spent more than a year in federal prison in Oregon. During his time in prison, Fog Cutter Capital’s board opted to pay him a bonus equal to the fine and continued paying his salary, a decision that attracted widespread criticism.

Wiederhorn is expected to be arraigned Friday afternoon in U.S. District Court in downtown Los Angeles. The remaining defendants’ arraignments are expected to be in the first week of June.

Related Posts

Amazon boss says AI will mean fewer ‘corporate’ jobs

Artificial intelligence myFT Digest — delivered directly to your inbox.

Read more

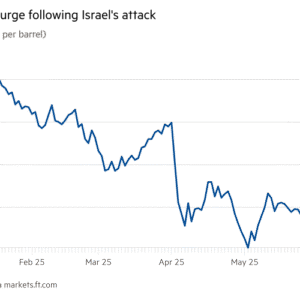

Oil prices surge after Israel’s attack on Iran

Oil myFT Digest — delivered directly to your inbox.

Read more