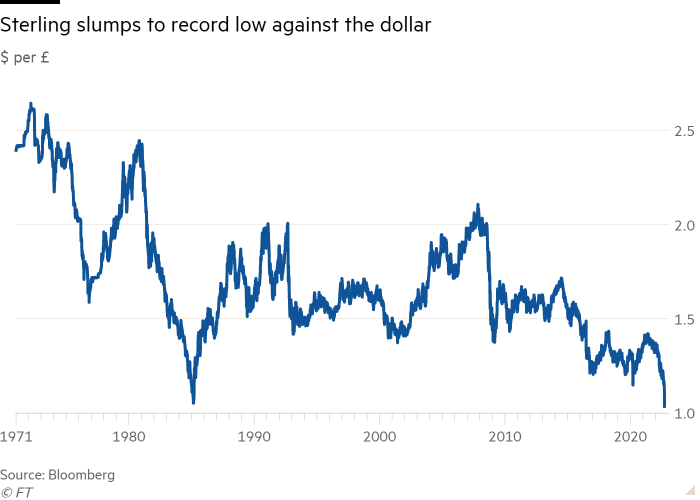

Sterling slid as much as 4.7 per cent against the dollar to $1.035, hitting a record low in Asian trading on Monday after UK chancellor Kwasi Kwarteng vowed to pursue more tax cuts.

The sharp moves in sterling came early in the Asia trading session, when low trading volumes in the pound-dollar pair can exacerbate volatility. In midday Asian trade, the pound was at $1.056 against the dollar.

Sterling also fell as much as 3.7 per cent against the euro to €1.0787, reaching the lowest level since September 2020.

The decline against the common currency highlighted how the pound’s recent fall reflects not just the broad strength in the dollar, but concern about Britain’s economy.

Kwarteng on Friday unveiled a £45bn debt-financed package containing the biggest set of tax cuts in half a century. UK government bonds sold off sharply, with the 10-year gilt yield surging 0.27 percentage points on heavy selling to hit 3.77 per cent.

The tax cuts come as the UK is already expected to spend £150bn to subsidise energy costs for consumers and businesses. A large portion of this borrowing is to be financed by gilts.

Unlike big tax cuts in the 1980s, Kwarteng is borrowing tens of billions of pounds to fund his plans, adding to demand at a time the Bank of England is raising rates to bring inflation under control.

“It looks like we’re headed for a spiral that we usually see in emerging markets crises, where policymakers struggle to reassert credibility,” said Mansoor Mohi-uddin, chief economist at Bank of Singapore.

Mohi-uddin said investor confidence in sterling had been undermined by expectations that UK public debt was now on an “unsustainable rising path” while the country was still running a “gaping current account deficit”.

“If we continue to see these huge moves in the market, the Bank of England will have to raise interest rates, perhaps as much as 1 percentage point, to try and stabilise the pound,” he added.

The Bank of England raised interest rates by 0.5 percentage points on Thursday, after a third successive 0.75 percentage point rate increase by the US Federal Reserve a day earlier.

“We had argued that the path forward for sterling would depend heavily on the monetary response to inflation over the near term and well-targeted fiscal measures, but so far the delivery has been less than encouraging on both fronts,” said foreign exchange analysts at Wall Street bank Goldman Sachs.

“With broad unfunded spending on the fiscal side unmatched by monetary policy to offset the inflationary impulse, the currency is likely to weaken further.”

Traders and analysts in Asia said low trading volumes in the region had likely exacerbated the downward pressure on sterling.

“It’s unusual to see the Asian markets setting the tone on this, because this region is usually the price-taker rather than maker,” said Benjamin Shatil, foreign exchange strategist at JPMorgan. “I suspect that we are seeing the relatively lower liquidity in these Asian markets playing a role here, with the fundamentals exacerbated by those liquidity dynamics.”

Additional reporting by Adam Samson in New York and Leo Lewis in Tokyo