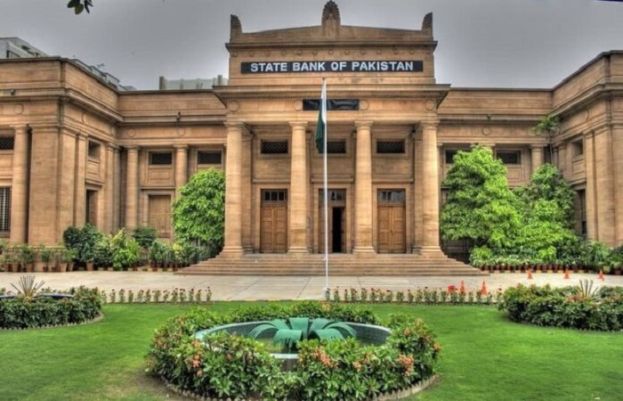

Foreign reserves held by the State Bank of Pakistan (SBP) have increased to $9.12 billion after the disbursement of the last tranche of $1.1 billion loan from the International Monetary Fund (IMF) under the short-term deal.

The SBP issued a statement on Thursday on the current position of the country’s liquid foreign reserves post-IMF inflow, confirming the central bank’s reserves stood at $9.12 billion in the week ending May 3.

Meanwhile, the net foreign reserves held by commercial banks stood at $5.3 billion, bringing the country’s total forex reserves to $14.45 billion — a nearly two-year high which was last recorded above $9 billion in mid-July 2022.

The SBP reserves increased by $1.114 billion to $9.1203 billion “mainly due to receipt of $1.1 billion from the global lender as final tranche” under the loan programme, the statement added.

Although, the central bank had received SDR 828 million (around $1.1 billion) from the global lender last month, the SBP made it clear that the amount would be reflected in the foreign exchange reserves for week ending on May 3.

The fresh tranche was the third and final of $3 billion Stand-By Arrangement (SBA) that the country reached with global lender last summer to avert default threat.

“Amount would be reflected in SBP’s foreign exchange reserves for week ending on May 3,” the central bank had said a day after the global lender approved the last tranche of Pakistan under the $3 billion Stand-By Arrangement (SBA).

Elaborating on the reserves’ position after the monetary policy meeting on May 2, the central bank’s governor, Jameel Ahmad, informed analysts that the forex deposits are currently in a comfortable position.

The SBP has paid off its commercial loans and now its debt profile consists of bilateral and multilateral loans, which has resulted in an improvement in the maturity profile of the debt, Ahmad said.

Despite weak financial inflows, the reduction in the current account deficit has enabled the central bank to make significant debt repayments, including the repayment of a $1 billion Eurobond, The News reported.

Meanwhile, Finance Minister Muhammad Aurangzeb also announced that a mission from the IMF is expected to arrive in Islamabad in mid-May to initiate talks for a new bailout.

He further said the country might have a staff-level agreement on the new programme by the start of July. The Fund and the government are already in talks for the new funding.

The country’s economy is struggling with a precarious balance of payments because it needs to repay nearly $24 billion in debt and interest over the next fiscal year—a sum that is significantly greater than the foreign currency reserves held by the central bank.