[ad_1]

G Chokkalingam, founder of Equinomics Research, told ET, “In the present circumstances, FPIs are adopting a risk-off strategy, foreseeing significant volatility leading up to the general election.” He has advised investors to limit their exposure to FPI-heavy stocks until the elections conclude.

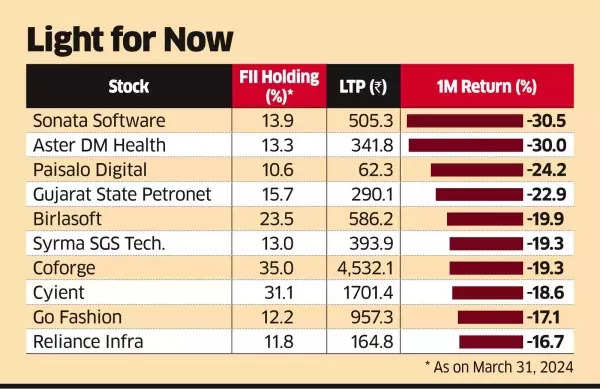

Several FPI-heavy stocks, such as Aster DM Health, Sonata Software, Paisalo Digital, Gujarat State Petronet, Coforge, and Birlasoft, have experienced drops between 20% and 30% in the past month.

FII Holding

While FPI selling may have contributed to this decline, analysts suggest that weaker-than-expected results in some of these companies have led to broad-based selling across various investor categories.

Large-cap stocks with higher-than-average FPI holdings, including Larsen & Toubro, HCL Technologies, Kotak Mahindra Bank, Titan, and DLF, have also fallen by more than 10%, with HDFC Bank, Infosys, and Bajaj Finance declining over 5% in just one month.

Also Read | Seven out of India’s top 10 wealthiest individual investors lost money in March quarter – check details

Joseph Thomas, head of research at Emkay Wealth Management, says, “FPI-heavy larger stocks have not given any returns to investors in the last two to three years.” He suggests that investors may consider staying invested in these stocks due to the lack of significant movements or explore mid-caps for better price performance.

The current selling trend by foreign investors marks a deviation from the patterns observed in the previous two general elections. In 2019, FPIs purchased shares worth nearly Rs 25,000 crore in the two months leading up to the election results, while in 2014, they acquired shares worth Rs 36,500 crore in the two months preceding the elections.

Some FPIs are reallocating their investments from Indian stocks to China and Hong Kong, which are currently trading at more attractive valuations compared to most global markets. VK Vijayakumar, chief investment strategist at Geojit Financial Services, has attributed the aggressive selling by FPIs to the outperformance of China and Hong Kong during the last month and the underperformance of India.

The Hang Seng Index in Hong Kong has surged by over 16% in one month and 18% in two months, while China’s Shanghai Composite has gained 4% and 15% in the last one and two months, respectively.

[ad_2]

Source link