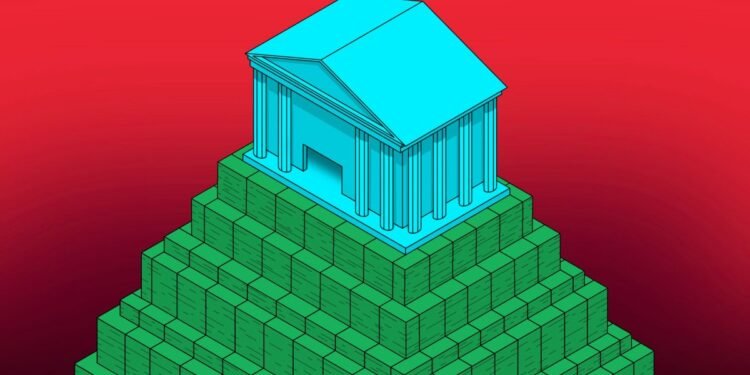

Title: Big Tech Tax Breaks Could Have Funded Benefits for Millions, Senator Warren Finds

In a recent report highlighting the financial implications of tax breaks granted to major technology companies, Senator Elizabeth Warren has drawn attention to the potential benefits that could have been funded for millions of Americans. Her analysis sheds light on the ongoing debate regarding corporate taxation and the role it plays in social equity and public welfare.

The Context of Big Tech Tax Breaks

In the past decade, tech giants like Amazon, Apple, Google, and Facebook have seen astronomical growth, contributing substantially to the stock market and, in many cases, reporting record profits. However, critics argue that the government’s approach to taxing these corporations has been less progressive. Many of these companies have exploited loopholes to significantly reduce their tax obligations, resulting in a meager tax contribution relative to their profits.

Senator Warren’s findings reveal that the cumulative tax breaks awarded to these companies could have provided essential services and benefits for millions of Americans, including healthcare, education, and infrastructure improvements. In her argument, Warren emphasizes that the current tax structure disproportionately benefits the wealthiest corporations while neglecting the needs of average citizens.

The Potential Benefits for Millions

According to Warren’s report, if even a fraction of the tax breaks received by Big Tech companies had been redirected towards social programs, the results could have been transformative. For instance:

-

Healthcare Access: The financial resources that tech companies save through tax breaks could be invested in healthcare initiatives. Senator Warren suggests that this could have expanded healthcare access for those who remain uninsured or underinsured, addressing a significant issue in the United States, especially following the COVID-19 pandemic.

-

Educational Enhancements: Tax savings could also be used to bolster public education funding, improving facilities, hiring additional teachers, and providing resources for low-income students. Access to quality education is pivotal to closing the inequality gap, and enhanced funding could significantly impact future generations.

-

Infrastructure Development: The infrastructure of the United States is in urgent need of repair and modernization. Redirecting tax revenues from Big Tech could facilitate jobs in construction, improve public transport options, and enhance connectivity in underserved areas.

A Growing Movement for Reform

Warren’s findings resonate with a growing sentiment among the public and policymakers advocating for tax reform, particularly in relation to large corporations. Many citizens feel that the current tax structure undermines social equity and disproportionately burdens lower and middle-income individuals.

As discussions around wealth inequality become more prominent, lawmakers are increasingly pushed to reconsider tax policies that favor large corporations at the expense of social programs meant to uplift citizens. Warren’s report is aimed at igniting this conversation, highlighting the need for fiscal responsibility and fairness in the facing of growing wealth disparities in America.

Conclusion

Senator Warren’s analysis of Big Tech tax breaks emphasizes a crucial pivot in the ongoing conversation about corporate taxation and public benefits. By showcasing the stark contrast between the incentives given to corporations and the needs of ordinary citizens, she calls for a reevaluation of fiscal policies that prioritize the wealthy at the expense of critical social support systems.

As debates about economic and social justice continue to evolve, the insights provided in Warren’s report serve as a vital reminder of our collective responsibilities towards fostering an equitable society—one where the prosperity generated by the technological revolution is shared by all. The path forward may require bold policy changes, but the potential benefits for millions of Americans are too significant to ignore.